Land Transfer Taxes seen as a barrier to home ownership

Home ownership is part of the 'Canadian Dream' say 90% of Ontarians, but a Municipal Land Transfer Tax (MLTT), like the one imposed in Toronto, would stand in the way of this dream for seven in ten Ontarians, if it were imposed in their municipality, according to new research from the Ontario Real Estate Association (OREA). In light of the unfolding provincial election, Ontario REALTORS® are raising awareness around the MLTT's restrictions on home ownership and its negative economic impacts to ensure it does not spread to municipalities outside of Toronto.

"Currently, only home buyers in Toronto have to pay a second land transfer tax in addition to the provincial land transfer tax," says Jim Holody, President of the London & St. Thomas Association of REALTORS®. “We want to ensure that London and St. Thomas's political leaders do not impose the tax on local home buyers. Home owners already pay enough taxes; a municipal land transfer tax would hurt the dream of home ownership for local residents."

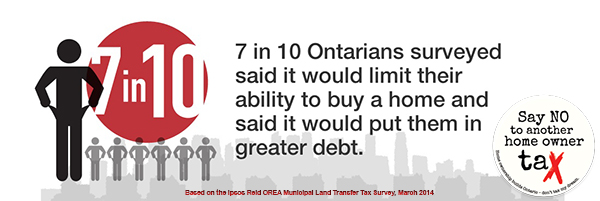

A new survey conducted by Ipsos Reid on behalf of OREA highlights Ontarians' concerns over the potential implementation of an MLTT in their area, which could add as much as $3,680 to the cost of a new home. Seven in ten Ontarians believe that the addition of an MLTT would:

- Limit their ability to afford a home purchase – 69%

- Make them incur more debt in order to pay the tax – 69%

- Delay their decision to purchase a home – 71%

- Make them more likely to consider buying a home in a municipality that does not charge an MLTT – 74%

- Make them spend less on renovations, furniture or appliances for the home they would purchase – 73%

Only the Government of Ontario has the authority to allow a municipality the right to implement a Municipal Land Transfer Tax. In 2008, the Government of Ontario allowed the City of Toronto to charge home buyers an additional Toronto Land Transfer Tax on top of the provincial Land Transfer Tax.

The economic losses incurred by Toronto since the tax was imposed have been significant. According to a recent report, Economic Implications of the Municipal Land Transfer Tax in Toronto, by Altus Group Economic Consulting, some of the impacts of the tax include:

- A loss of 38,278 resale home transactions

- A loss of $2.3 billion in economic activity

- A reduction of $1.2 billion in GDP

- A loss of 14,934 full-time jobs

- A loss of $772 million in wages and salaries

"The research proves how detrimental an MLTT can be for an economy," says Holody. "It's bad for the economy, adds to household debt and pushes the dream of home ownership even further away. Our local economy cannot afford the job losses and economic damage that happens when an MLTT is introduced. We need to learn from the Toronto experience and say no to the tax."

Resale housing transactions across Ontario generate significant economic activity. The purchase and sale of homes generates fees to professionals such as lawyers, appraisers, REALTORS® and surveyors, as well as taxes and fees to government. In addition, homebuyers often purchase new appliances or furnishings and typically undertake renovations that tailor the new home to specific household requirements.

"The MLTT gets in the way of the economic spin-off that occurs when homes are purchased and sold," says Holody. "It should be repealed in Toronto and it should never be endorsed by the provincial government for any other municipality in this province."